Without an estate plan, you have no control over what happens to your assets upon your death. Instead, it will depend on state laws and the courts. This is not ideal, especially if you have particular beneficiaries and preferences in mind. Here’s more on what happens when you don’t have an estate plan.

Without an estate plan, you have no control over what happens to your assets upon your death. Instead, it will depend on state laws and the courts. This is not ideal, especially if you have particular beneficiaries and preferences in mind. Here’s more on what happens when you don’t have an estate plan.

Probate

A probate process is required to settle your estate. The courts will decide how your assets are distributed after debts are settled. Potential heirs are given an opportunity to make claims against your estate. This process can take several months, or even years, to complete. In lieu of a will, heirs are determined by Intestate Succession laws in Massachusetts.

Intestate Succession

Intestate succession is the logic used by the courts to identify your heirs based on your living family members. For example, if you are not married but have children, your children will inherit your estate. If you have a spouse and children with that spouse, then your spouse is the sole heir. These are straight forward examples. It gets more complicated if you have different combinations of relatives such as children from multiple marriages, a spouse and living parents but no children, etc.

Unintended Heirs

Intestate succession laws will not necessarily match your preferences on who should benefit from your estate. In many cases, the lack of an estate plan will lead to unintended heirs. The laws do not take into account your personal relationships with those relatives. For instance, you may have a sibling that you haven’t seen in 20 years. That sibling will have just as much right to your estate as another sibling with whom you maintain a close relationship. This is, unfortunately, what happens when you don’t have an estate plan and why a will and other estate planning instruments are so important.

Squandered Assets

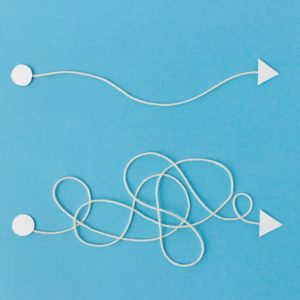

Estate planning goes beyond simply creating a will. Through things like trusts, you can control the distribution of assets over time or to cover particular circumstances. Otherwise, they could get squandered or misused,… negatively impacting the lives of your heirs instead of providing the help that you intended. For example, giving a 21 year old $500,000 in assets from an estate might not be the best idea. At that age, he/she may not have the maturity and financial skills to manage those funds properly. Just as some people who win the lottery end up in bankruptcy, lump sum payments to young adults can surprisingly lead to poor decisions and financial hardship later on.

Summary What Happens When You Don’t Have an Estate Plan

These are just a few examples of what happens when you don’t have an estate plan. There could be many more unwanted consequences. The key is not only to prepare an estate plan, but to create a well thought out that remains updated as changes occur in your life. With such an important legal document, be sure to consult with an estate planning attorney. If you don’t yet have one, we would be happy to assist you. Contact us to schedule a consultation.